Why Does Malaysia Cars Have So Many Tax

If it was a flat rate then the poor could be seen t. So thats RM380 RM494 making up a total of RM874.

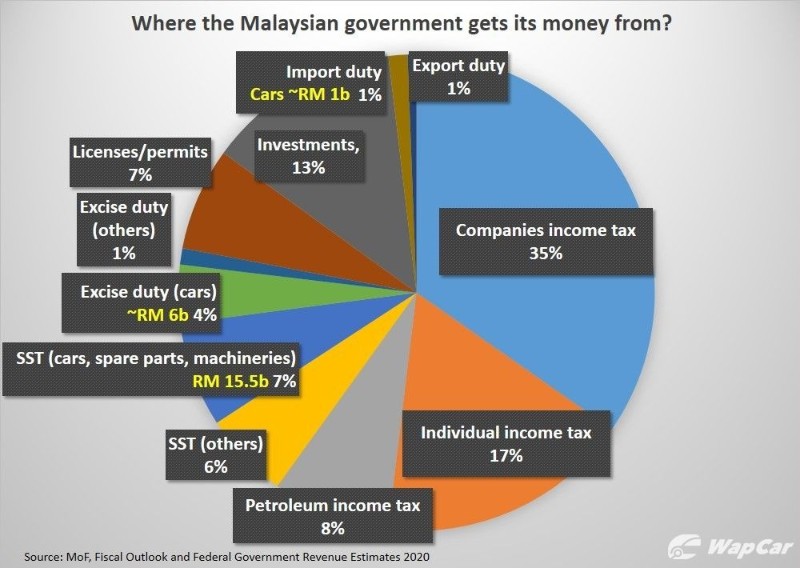

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Road tax is even cheaper for cars in East Malaysia for both saloon and non-saloon cars.

. Further good news to company owners as the same rates apply to both privately and company. RM050 progressive rate x 200 RM100. I drive a KIA NAZA Sorento and it was 115000 RM.

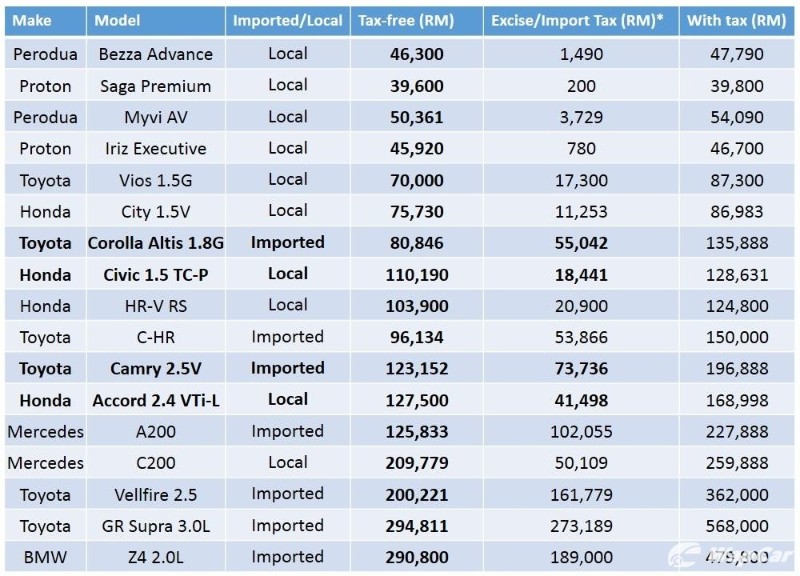

For a company-registered vehicle a. A similarly equipped Prius sells for only around RM80000 in the US and Japan. On top of that RM1 is added on for each cc exceeding 2000 cc.

JPJ are clearly upping the squeeze here but it isnt anything too crazy yet. So this puts your car into the 100kW 125kW bracket for the road tax. Take for example a Japan-made 2013 Toyota Prius which starts at RM140000 in Malaysia.

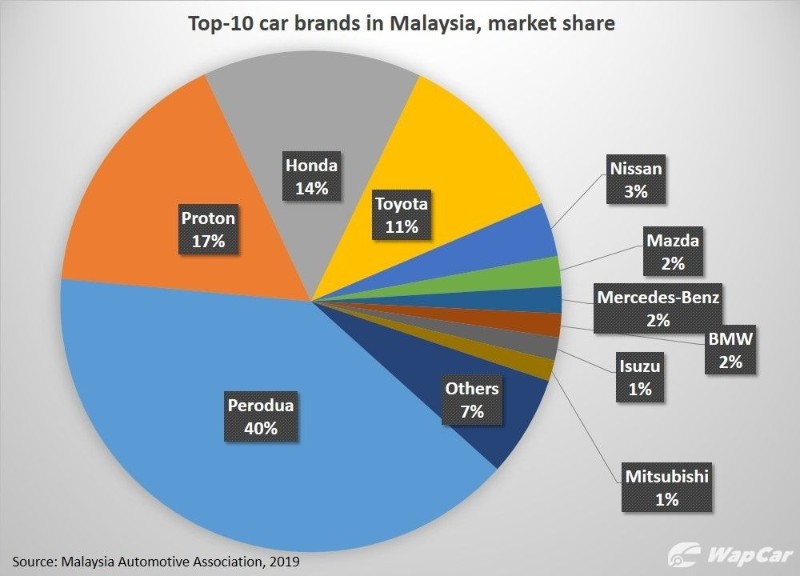

Malaysias car industry is dominated by two local manufacturers. KUALA LUMPUR Feb 25-- There are four months left for Malaysians to buy locally made or imported cars and enjoy tax incentives which will end soon said Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz. Engine displacement Cubic Capacity Liter.

The vehicle tax system in Malaysia allows the sale of an imported car to be tax free if kept on the tax free island of Langkawi. Total road tax. In our current roadtax calculation assumption is taken that bigger enginesdisplacement emits more pollution.

Bigger engines pays more tax. For example a privately owned Proton Preve of 1597 cc that was bought in Peninsular Malaysia would sum to RM90 for road tax a year. Annual car Roadtax price in Malaysia is calculated based on the components below.

Then every 90 days in one year 365 days this tax free car is allowed into Peninsula Malaysia as long as it has valid road tax and insurance to be driven by its owner and then it must be. Here the tiers base rate is RM380. For instance the total tax charges for a Toyota Vellfire could come up to about RM110000 before exemption ballooning the on-the-road price to RM382300 25L model.

The VW Passat is at 170000 RM a Ford Pickup is 85000 RM. Cars between 1601-1800cc engine capacity have a base rate of RM200 annually and increase by RM040 per cubic centimetre capping the maximum annual rate at RM280. This sales tax exemption on purchases of new vehicles was previously granted from 15th June 2020 until 31st December 2020 and was further extended by another 6 months to 30 June 2021 by the MoF as an incentive to spur car sales at a time when.

As said imported cars have a hefty tax. Malaysians often complain that because of high taxes they have pay some of the highest car prices in the world. RM274 base rate Remaining 10kW.

Presumably its a form of progressive tax. So those that buy a car with larger engine capacity are likely to be richer. A company owned Preve would sum up to RM180 a year.

Hans July 01 2013 1217 pm. RM140000 is incurred on 1. That why lorry have the higher road tax compare to car.

He said the Finance Ministry under Budget 2022 had extended the car sales tax incentive exemption period until June 30 2022 to encourage car ownership. Do note that recently in Malaysias Budget 2022 the government has announced that there will be tax-free incentives for EV cars inclusive of road tax. The price increase is because Malaysia uses an outdated tax system.

Answer 1 of 2. Malaysia have all these laws so protect people in cases for insurance claims. Here is how it works.

Although car prices are on the higher side in Malaysia were blessed with comparatively cheap fuel prices our current fuel price is RM 138 for a litre of RON95. Folks in Australia arent as fortunate as us as they need to pay up to 3 times more for fuel on top of more expensive running costs insurance servicing etc. There is some truth in that argument.

In Malaysia sales tax for vehicles has been set at 10 for both locally assembled and imported cars. For foreign-made cars that are imported into Malaysia the 100 duty exemption would be applicable up to December 31 2023. Progressive rate is capped at RM160 per cc only from 2500 cc onwards while a privately registered saloon car can be levied up to RM450 per cc from 3000 cc onwards.

For owners residing in Sabah or Sarawak the road tax is RM56 a year for both privately and company owned. But besides the Malaysia cars like Proton and Perodua a couple of brands have local manufacturing. Outright purchase for cash.

Aside from 100 tax exemptions on EV next year there will also be an income tax relief of up to RM2500 for those who have purchased rented or have been paying to charge their electric vehicle should the budget be passed. But things are slightly different for cars above 20 cc. Malaysia is rumoured to have some of the highest car prices in the world due to a costly combination of high duties and taxes levied on cars and a policy aimed at protecting the local car manufacturing industry and reducing loss from the outflow of Ringgit to foreign countries.

Let us now look at the tax implications of each of the options for the years of assessment 2014 until 2021. Combined with the 10 sales tax tax charges for cars can come up to quite a substantial amount making Malaysia one of the countries with the highest tax on cars globally. On the other hand those who are on basic income will likely get a function car with small engine capacity.

Between 16L and 30L road tax can range between RM200 to RM2130 per year. Even for those who decide in opting for a more humble set of eco-friendly wheels meanwhile. Monthly lease payment of RM3000 commencing 1 May 2014.

The road tax Porsche Taycan Turbo S locally for instance costs a hefty RM 12094 every year while Malaysians with a dream of owning a lightning-fast Tesla Model S Plaid will be starring down the barrel of an annual road tax bill that totals RM 17862.

Electric Car Market Share Financial Incentives Country Comparison

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Available Today Drive Away Tomorrow

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Comments

Post a Comment